Advocates for the Policyholder

Claims Aid Consultants public adjusters are licensed, bonded and state regulated insurance professionals who provide claim adjusting services exclusively for policyholders.

Disputes between a policy holder and their insurance company are common when filing property damage claims. Policy holders don’t have the experience required to meet a number of policy conditions and statutory requirements to avoid claim denials.

Hiring a professional public adjuster for claim adjusting services will ensure that you receive a fair and just compensation when you suffer a loss.

What does a public adjuster do for me?

A public adjuster works for you—not the insurance company. We inspect your property damage, review your policy, prepare a detailed estimate, and negotiate your settlement. Our goal is to make sure you receive the full compensation you deserve.

Need help now? Contact us for a free claim review at 772-249-7988 today!

Do you offer free inspections for property damage?

Yes. We provide a free on-site inspection to document your damage and explain what your insurance policy should cover.

Book your free inspection in minutes by filling out the form here>>

Can you help if my insurance claim was denied or underpaid?

Yes. We specialize in reopening denied or underpaid claims. We reassess the damage, prepare new documentation, and work to recover additional compensation.

Get a second opinion—no cost, no obligation.

What types of claims do you handle?

We help with hurricane damage, wind and hail, roof leaks, pipe bursts, water damage, mold (when covered), fire and smoke damage, and commercial property losses.

Not sure if your damage qualifies? Just ask!

How much does it cost to hire a public adjuster?

There are no upfront fees. We work on contingency, meaning we only get paid if we recover money for you.

Call us to learn more about our process.

How long will my insurance claim take?

Most claims take weeks to several months, depending on the complexity of the damage and insurer response times. We keep the process moving and update you regularly.

Want a timeline estimate? Reach out anytime.

Should I get a second opinion after the insurance adjuster’s inspection?

A second opinion helps ensure the damage is fully documented and valued correctly. Insurance adjusters represent the insurer, not you.

Let us double-check your estimate for free!

What should I do right after property damage?

Take photos, prevent further damage if possible, and contact a public adjuster early. Early documentation can significantly strengthen your claim.

Need immediate guidance? We’re here to help.

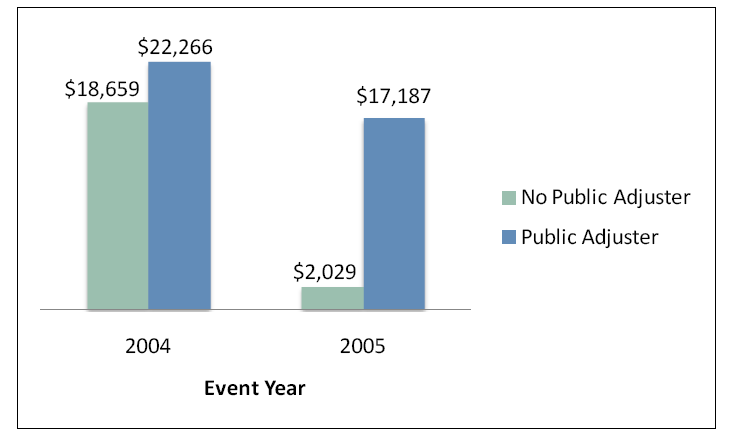

A study by the Office of Program Policy and Government Accountability (OPPAGA) published in January of 2010, confirmed policy holders with public adjusters for non catastrophic losses receive on average a 547% increase on compensation for their property damage claims. On catastrophic losses the number jumps to a 747% increase.

Insurance is big business, and you are not on a level playing field with a big insurance company.

Many of the tasks that are required in your recovery favor the insurance company, but when a public adjuster is representing you, they will protect your interests in documenting and presenting the claim on your behalf to maximize and expedite your insurance recoveries.

Documenting and navigating a catastrophic property loss is time-consuming and burdensome to even the most sophisticated insured, and unfortunately claim denials are common when handled alone by the policyholder.

It is hard for you, the insured, to know whether you are getting all that is owed under your insurance policy for your property damage claim.

Your policy may actually give you extended coverage’s beyond the stated dollar limits on the policy and way more than the insurer offers you for your insurance claim.

An experienced claim adjusting services advocate on your side can be a strong voice for you in the process and give you much more input and negotiating leverage on your final insurance settlement than you’d have on your own.

– Amy Bach, Co-founder of United Policyholders”

“Many people describe their insurance claim experience as a

full time job. Negotiating a fair claim settlement can be very challenging, especially after an emotionally devastating catastrophe.

If you rely completely on your insurance company to calculate the amount of damage and you’re owed, you’re unlikely to recover a

full or fair settlement.”

Instead of relying on the insurance company to decide how much you get to rebuild your home, hiring a good public adjuster can help you receive the best possible settlement.

Claims Aid Consultants Public Adjusters are skilled, knowledgeable and experienced loss experts who provide claim adjusting services exclusively to policyholders. We investigate, research and prepare the necessary documentation for your claim, and negotiate your loss with the insurance company’s representative so you receive the best possible insurance settlement.

“If you experience a sizable loss, consider hiring a public insurance adjuster who will file and submit your claim on your behalf.

– Angie Hicks, Founder of Angie’s List®

These adjusters often have years of experience on the private insurance side and work to get homeowners the best

settlement possible.”

Maximize Your Insurance Claim Settlement

No upfront fees. Expert claim handling.

- Free initial consultation

- Expert damage appraisal

- Direct negotiation with insurers

- Maximizing claim settlements

- No recovery, No fee!

You must be logged in to post a comment.